What Should Be Included on Your Budget Calendarīudget calendars are helpful regardless of how you budget or the tools you use. Some suggestions would be Virtual Wallet, CalendarBudget, or Moneydance. However, there are dedicated calendar budgeting apps you can try. 101 Planners, My Money Coach, and On Planners are worth exploring. You can then access that calendar whenever and wherever you please.Īlternatively, if you don’t want to create a budget calendar, you can use a budget calendar template. For example, if you already use Google Calendar, you can make a separate budget calendar. But a digital or calendar app will likely work best for you. You need a blank calendar, and this could just be an old-school paper calendar if you prefer. So, how do you actually set up a Calendar for your budget? You’ll first need to choose what type of calendar to use. Hopefully, you’re sold on a budget calendar because of the benefits listed above. And in my opinion, a calendar has a much easier learning curve than most budgeting software. Your Calendar will help you to avoid late payments. More than a quarter of millennials had their checking accounts overdrawn, but a Calendar can be a solution to dealing with the anxiety of late payments. The advantage of using calendars is that they assist you in seeing when things are due.

#TOP BUDGET CALENDAR PRINTABLE PLUS#

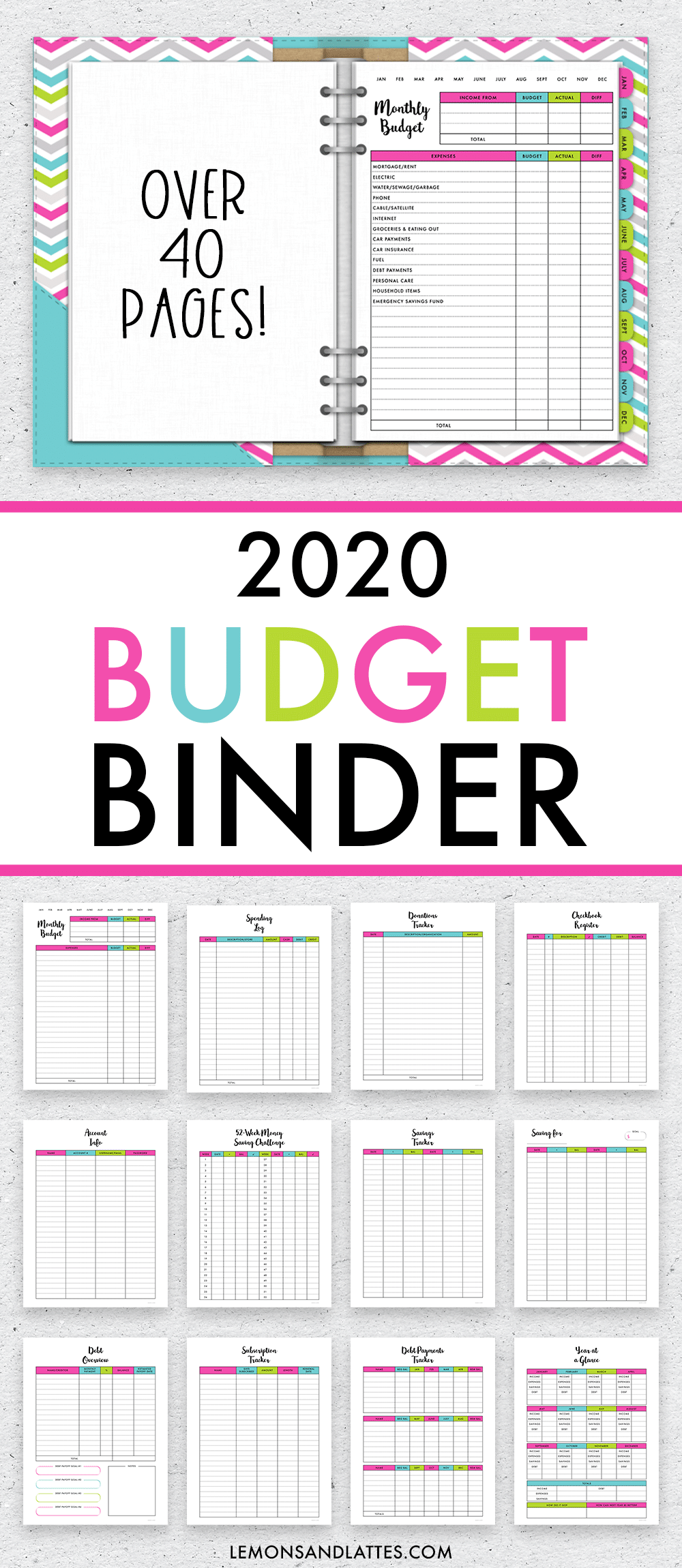

These could be semiannual car insurance payments or an annual Disney Plus subscription. Don’t forget to include infrequent bills as well. Examples would be rent and credit card, and cellphone bills. You should mark your calendar once you know when your next paycheck is coming, or at least when to expect it. Whatever calendar you use, it should contain the following But, there are more than enough apps and templates designed specifically for budget calendars. Your existing calendar, whether paper or digital, will work just fine. More specifically, it helps estimate how much money you have coming in and out each month. Simply put, a budget calendar is a calendar that tracks payments and due dates.

#TOP BUDGET CALENDAR PRINTABLE HOW TO#

And, to get you started on the right foot, here’s how to set yourself for financial success using a budget calendar. In short, if your want is financially successful, then you need a budget calendar. After all, you can keep track of your financial goals, track your bills, and manage your cash flow with a budget calendar. While a budget won’t completely resolve your financial woes, it can help. It’s stressful and prevents you from achieving your goals. I can tell you that when I first started budgeting, I nearly gave up in frustration.ĭespite this, living paycheck to paycheck is no way to live - which is valid for 7 in 10 people. And sticking to your budget even more so. But, at the same time, creating a budget can be daunting. I’m sure you know how important it is to create a budget. But have you ever thought about adding your budget to your calendar? Many of us even rely on calendars to keep our entire lives in order. As you hopefully know, a monthly calendar is an invaluable tool for keeping track of important dates and events.

0 kommentar(er)

0 kommentar(er)